UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed

by the Registrant x

Filed by a Party other than the Registrant

¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x |

Definitive Proxy Statement |

| ¨ |

Definitive Additional Materials |

| ¨ |

Soliciting Material under §240.14a-12 |

| WAYSIDE TECHNOLOGY GROUP, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) |

Title of each class of securities to which transaction applies: |

| (2) |

Aggregate number of securities to which transaction applies: |

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) |

Proposed maximum aggregate value of transaction: |

| (5) |

Total fee paid: |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) |

Amount Previously Paid: |

| (2) |

Form, Schedule or Registration Statement No.: |

| (3) |

Filing Party: |

| (4) |

Date Filed: |

WAYSIDE TECHNOLOGY GROUP, INC.

4 Industrial Way West, 3rd Floor

Eatontown, New Jersey 07724

MESSAGE FROM THE BOARD OF DIRECTORS

Dear Wayside Technology Group Shareholders:

You are cordially

invited to attend the 2021 Annual Meeting of Stockholders (the “Meeting”) of Wayside Technology Group, Inc., a Delaware corporation

(the “Company”), which is scheduled to be held on June 8, 2021 at 10:00 a.m., Eastern Time, and any postponements

or adjournments thereof. Due to the public health impact of the coronavirus outbreak (COVID-19), and to support the health and well-being

of our employees and stockholders, this year’s Meeting will be a virtual meeting of stockholders, conducted via live audio webcast.

You will be able to attend the Meeting and vote and submit questions during the Meeting via live audio webcast by visiting www.virtualshareholdermeeting.com/WSTG2021.

As always, your vote is important. Details of the business to be conducted at the Meeting and how to participate in the meeting are given

in the accompanying Notice of Annual Meeting of Stockholders and the Company’s proxy statement.

2020 proved to be a very challenging year filled

with both challenges and opportunities. The most challenging surprise we faced was the COVID-19 pandemic and consequent economic disruption.

Your management team and employees did an outstanding job in safely regrouping, while continuing to provide high-touch service to both

our customer and vendor communities.

On the opportunity side, your management team completed

two acquisitions in 2020. The acquisitions of Interworks in Canada closed in April and CDF (d/b/a Sigma/Grey Matter) in the UK closed

in November. We believe that the Sigma/Grey Matter acquisition will enhance many of our current product offerings and that CDF’s

consulting group, Cloud Know How, will help Climb launch a Cloud Services Platform (CSP) in 2021.

These acquisitions were the first for Wayside in

25 years and reflect the alert and opportunistic mindset of our management team. Through prudent financial management we were able to

free-up nearly $40 million of balance sheet capital which was used in part to finance both acquisitions in cash. We increased the value

of our enterprise, created additional earnings, and ended the year with a substantial remaining cash balance.

We had many notable operational accomplishments

throughout the year. The following summarizes just a few:

| · | We added a dedicated sales team for Tintri. Our sales with them rose by nearly

400% in 2020 versus 2019; consequently, we were named “Distribution Partner of the Year.” |

| · | We added a dedicated sales team for Micro Focus. Our sales with them almost

doubled in 2020 compared to 2019. |

| · | We continued to penetrate the large value-added reseller (VAR) marketplace

as we transacted with 160 more VARs in 2020 than in 2019. |

| · | Although we do business with all major industry DMRs, in 2020 we focused

significant sales efforts on CDW, SHI and Insight. Since 2018, our top-line US revenue with these three key strategic partners continues

to see significant increases. |

| · | On May 18, 2020 we rebranded to Climb Channel Solutions, retiring the legacy

Lifeboat Distribution name. This change memorializes the evolution of our company from an operations/order-taking focused company to a

sales-focused organization that targets the development of emerging technology vendors. Many of the improvements we made to our operations,

vendor recruitment, and sales and marketing are reflected in our record financial performance. |

| · | Climb Elevate, a wholly owned subsidiary of Climb Channel Solutions, Inc.,

was launched in late 2020, representing a logical extension of our enterprise strategy. Climb Elevate focuses on efficient quote-to-ship

processes for emerging technology brands that are not quite ready for a full distribution play. Climb Elevate will open new opportunities

for our organization and significantly broaden the scope of new brands we can take to market. |

Our leadership team firmly believes that, while

very difficult to quantify, a continued significant cultural shift is occurring at the Company. Our primary focus is relationship-based

selling. We believe we need to be best in class operationally, but we are now recognized first and foremost as a sales company.

Our revenue continues to grow as do our earnings

from operations, a consequence of hard work and creativity. We will continue to evaluate strategic uses of our balance sheet cash and

operating cash-flow, which we anticipate will increase this year, due in part to organic growth and in part to our newly acquired businesses.

Your Board of Directors has been refreshed over

the past few years, most recently in June of 2020 when Ms. Carol DiBattiste joined the Board. She brings excellent business, legal and

analytical skills to our Board group. This year we thank Ms. Diana Kurty for her years of service and noted contribution as Chair of our

Audit Committee. She will be leaving our Board as we welcome Ms. Gerri Gold, who has been nominated for election at the Meeting. Gerri

brings many years of technology, finance and executive management experience. We have assembled an intellectually diverse Board representing

individuals from a variety of professional backgrounds. Each offers unique strategic, management and business perspectives that add greatly

to the intellectual output you should expect from your Board.

During 2020 we established a new committee of

the Board, Risk & Security. This is an increasingly important area of concern, particularly for public companies. To date the committee

has meet a half a dozen times and further solidified our already robust policies and procedures.

Capital allocation continues to be an integral

function of your Board and management team which heavily influences our long-term strategy. You would be pleased by the amount of thoughtful

time and energy devoted to coordinating our capital allocation plan with our strategic operating plan. This energy is a derivative of

the diversity of thought coming from around our Board table.

As your Board Chair, I am happy to report high

levels of corporate governance, attention to detail, and focus on the creation of shareholder value. As an investment professional I spend

significant time interacting with public company management teams and board directors. The group of individuals assembled at Wayside is

nothing short of extraordinary, in my opinion. To each I offer my sincerest thanks for a job well done.

As we look ahead to 2021 and beyond, the future

appears bright. We have a great team lead by our CEO, Dale Foster, an industry-experienced executive who is respected and admired throughout

the industry. His team is dedicated and focused, consistently looking to the future and building an enterprise with lasting value.

On behalf of your entire Wayside team, we express

our gratitude for your support over the past year and your encouragement in the years ahead.

Your Chair,

Jeffrey R. Geygan

The accompanying Notice of

Annual Meeting of Stockholders and proxy statement are first being made available to stockholders beginning April 16, 2021.

WAYSIDE TECHNOLOGY GROUP, INC.

4 Industrial Way West, 3rd Floor

Eatontown, New Jersey 07724

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 8, 2021

Dear Stockholders:

Notice is hereby given that

the 2021 Annual Meeting of Stockholders (the “Meeting”) of Wayside Technology Group, Inc., a Delaware corporation (the “Company”)

is scheduled to be held on June 8, 2021 at 10:00 a.m., Eastern Daylight Time via live audio webcast, for the following purposes, which

are more fully described in the accompanying proxy statement:

| |

1. |

To vote upon on the election of seven directors to the Company’s Board of Directors (the “Board”), each to serve until the next annual meeting of stockholders and until his or her successor is duly elected and qualified (Proposal 1); |

| |

2. |

To vote upon a non-binding, advisory resolution

to approve the executive compensation of the Company’s named executive officers, as described in the accompanying proxy statement

(Proposal 2);

|

| |

3. |

To vote upon the ratification of the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2020 (Proposal 3); and |

| |

4. |

To vote upon the approval of the Wayside Technology Group, Inc. 2021 Omnibus Incentive Plan, as described in the accompanying proxy statement (Proposal 4). |

Stockholders may also consider

and take action on such other matters as may properly come before the Meeting and any postponement or adjournment thereof.

The Board recommends a vote

“FOR” each of the Company’s seven nominees for directors named in the accompanying proxy statement and a vote “FOR”

each of Proposal 2, 3 and 4.

You will be able to attend

the Meeting, vote your shares electronically and submit your questions during the meeting via live audio webcast by visiting www.virtualshareholdermeeting.com/WSTG2021.

In order to participate in the Meeting, you must enter the 16-digit voting control number found on your proxy card, voting instruction

form or notice that you received previously. If you do not have your control number, you may elect to participate in the Meeting as a

“Guest”, but you will not have access to vote your shares or ask questions during the virtual Meeting. You will not be able

to physically attend the Meeting.

The close of business on

April 13, 2021 has been fixed as the record date for the determination of stockholders entitled to notice of and to vote at the Meeting

and any postponement or adjournment thereof. A list of these stockholders will be open for examination by any stockholder electronically

during the Meeting at www.virtualshareholdermeeting.com/WSTG2021 when you enter your control number. The Meeting may be adjourned

from time to time. At any adjourned meeting, action with respect to matters specified in this notice may be taken without further notice

to stockholders, unless required by law or the Company’s Amended and Restated Bylaws (the “Bylaws”).

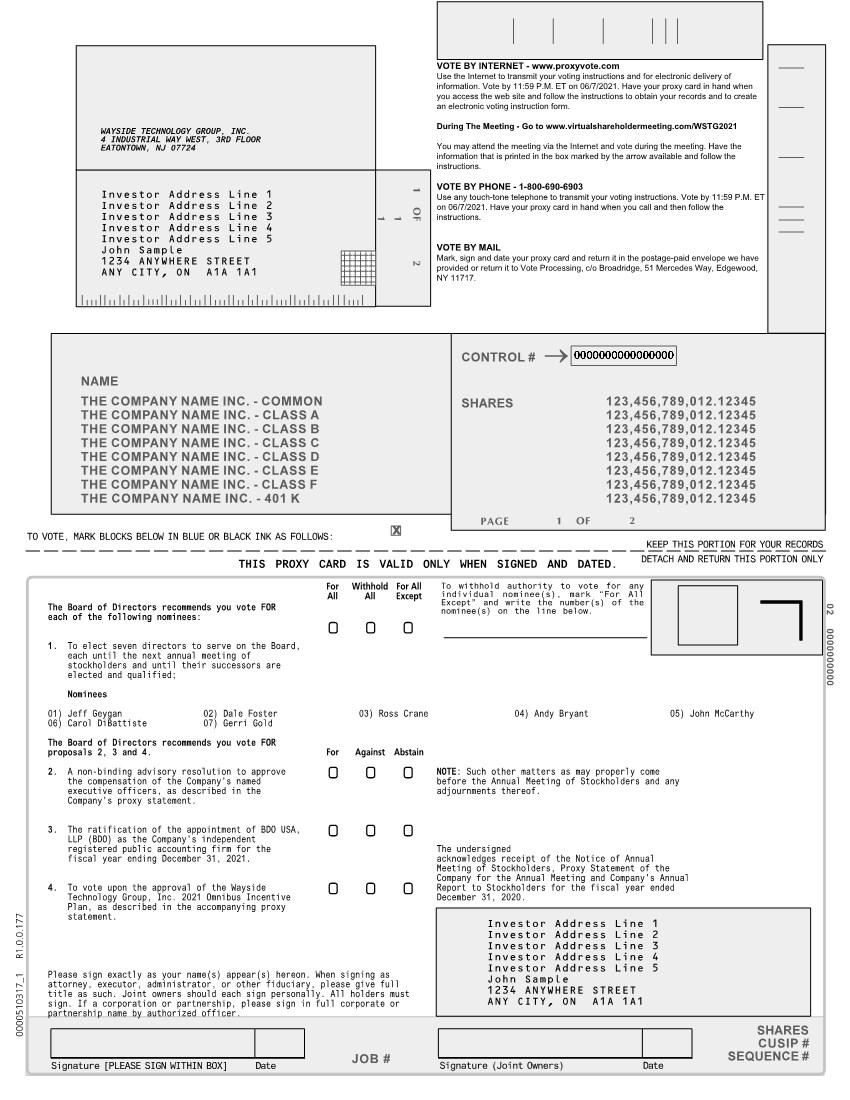

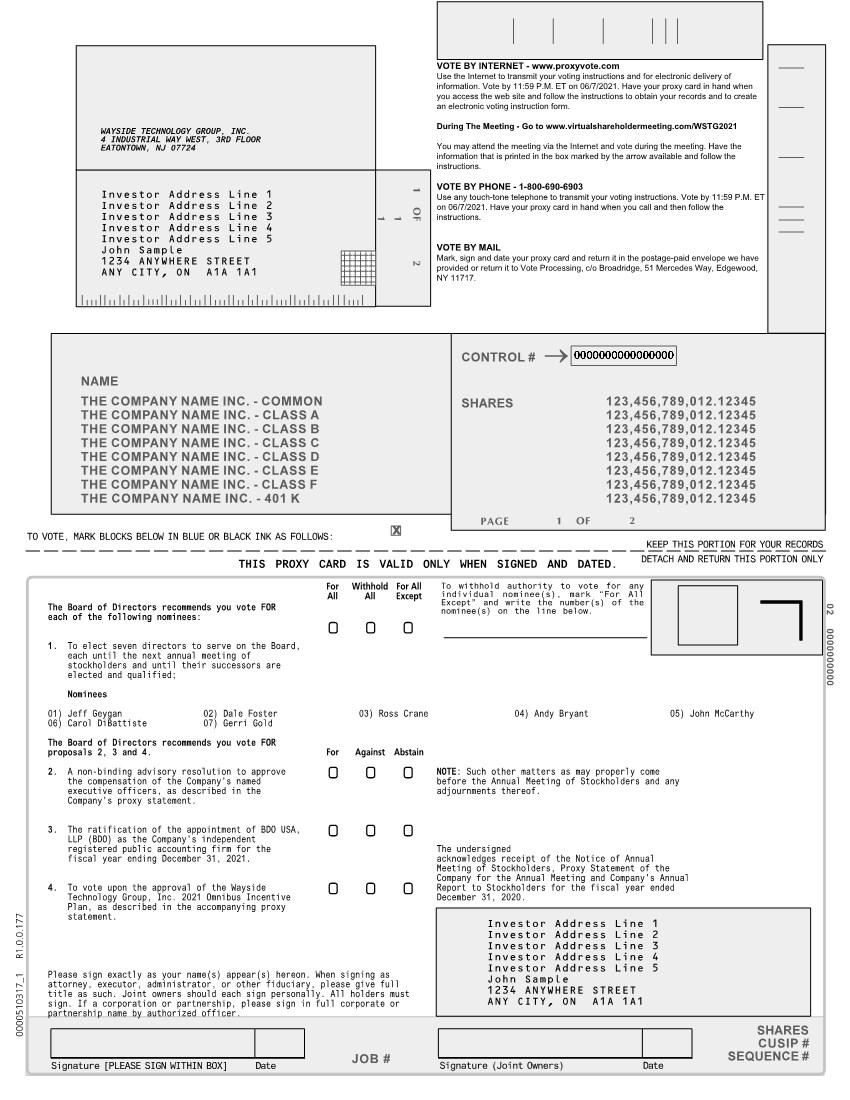

Whether or not you expect

to attend the Meeting, we encourage you to submit your proxy as soon as possible using one of three convenient methods by (i) accessing

the Internet site described in your proxy card or voting instruction form provided to you, (ii) calling the toll-free number in your proxy

card or voting instruction form provided to you, or (iii) completing, signing, dating and returning the enclosed proxy card promptly in

the accompanying envelope, which requires no postage if mailed in the United States, or voting instruction form provided to you. If your

shares are held in street name, you will receive a voting instruction form from the holder of record. Regardless of the number of shares

of common stock of the Company that you own, your vote is important. Thank you for your continued support, interest and investment in

Wayside Technology Group, Inc.

| |

By Order of the Board of Directors, |

| |

|

| |

/s/ Jeff Geygan |

| |

Chairman |

| |

|

| |

April 16, 2021 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF PROXY MATERIALS FOR THE MEETING TO BE HELD ON JUNE 8, 2021.

The accompanying proxy statement,

the accompanying proxy card, and the Company’s Annual Report to Stockholders (including its Annual Report on Form 10-K for the fiscal

year ended December 31, 2020) are available free of charge at www.proxyvote.com. Information on this website, other than this proxy statement,

is not a part of this proxy statement.

********************

The accompanying proxy statement

provides a detailed description of the business to be conducted at the Meeting. We urge you to read the accompanying proxy statement,

including the appendices, carefully and in their entirety.

WAYSIDE TECHNOLOGY GROUP, INC.

4 Industrial Way West, 3rd Floor

Eatontown, New Jersey 07724

PROXY STATEMENT

This proxy statement is furnished

in connection with the solicitation by the Board of Directors (the “Board”) of Wayside Technology Group, Inc., a Delaware

corporation (the “Company”) of proxies to be voted at the Annual Meeting of Stockholders (the “Meeting”) to be

held on June 8, 2021 at 10:00 a.m., Eastern Time, and at any postponements or adjournments thereof, for the purposes set forth in

the accompanying Notice of Annual Meeting of Stockholders. You will be able to attend the Meeting, vote your shares electronically and

submit your questions during the meeting via live audio webcast by visiting www.virtualshareholdermeeting.com/WSTG2021. In order

to participate in the Meeting, you must enter the 16-digit voting control number found on your proxy card, voting instruction form or

notice that you received previously. If you do not have your control number, you may elect to participate in the Meeting as a “Guest”,

but you will not have access to vote your shares or ask questions during the virtual Meeting.

The approximate date on which

this proxy statement and the accompanying proxy card is first being made available to the Company’s stockholders is April 16,

2021.

QUESTIONS AND ANSWERS ABOUT THE MEETING

Why am I receiving this proxy statement?

The Board is soliciting your proxy vote for the

Meeting because you owned shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”), at the

close of business on April 13, 2021 (the “Record Date”) for the Meeting, and therefore, are entitled to vote at the Meeting

on the following proposals:

| |

· |

Proposal 1: The election of the seven directors to serve on the Board, each until the next annual meeting of stockholders and until his or her successor is duly elected and qualified; |

| |

· |

Proposal 2: The approval of a non-binding advisory resolution to approve the compensation of the Company’s named executive officers, as described in this proxy statement; |

| |

· |

Proposal 3: The ratification of the appointment of BDO USA, LLP (“BDO”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020; and |

| |

· |

Proposal 4: The approval of the Wayside Technology Group, Inc. 2021 Omnibus Incentive Plan, as described in this proxy statement. |

Stockholders may also consider and take action

upon such other matters as may properly come before the Meeting and any postponement or adjournment thereof.

THE BOARD UNANIMOUSLY RECOMMENDS VOTING “FOR”

THE ELECTION OF EACH OF THE BOARD’S NOMINEES ON PROPOSAL 1, “FOR” PROPOSAL 2, “FOR” PROPOSAL 3 AND “FOR”

PROPOSAL 4.

When and where will the Meeting be held?

The Meeting is scheduled

to be held on June 8, 2021, at 10:00 a.m., Eastern Time. Due to the public health impact of the coronavirus outbreak (COVID-19), and

to support the health and well-being of our employees and stockholders, this year’s Meeting will be a completely virtual meeting

of stockholders, conducted via live audio webcast. You will be able to attend the Meeting and vote and submit questions during the Meeting

via live audio webcast by visiting www.virtualshareholdermeeting.com/WSTG2021. You must enter the 16-digit voting control number

found on your proxy card, voting instruction form or notice that you received previously. If you do not have your control number, you

may elect to participate in the Meeting as a “Guest”, but you will not have access to vote your shares or ask questions during

the virtual Meeting.

Who is soliciting my vote?

The Board, on behalf of the

Company, is soliciting your proxy to vote your shares of Common Stock on all matters scheduled to come before the Meeting, whether or

not you attend the Meeting. By completing, signing, dating and returning the proxy card or voting instruction form, or by submitting your

proxy and voting instructions over the Internet or by telephone, you are authorizing the persons named as proxies to vote your shares

of Common Stock at the Meeting as you have instructed.

You may also be solicited

by press releases issued by us, postings on our corporate website or other websites or otherwise. Unless expressly indicated otherwise,

information contained on our corporate website is not part of this proxy statement. In addition, none of the information on the other

websites, if any, listed in this proxy statement is part of this proxy statement. Such website addresses are intended to be inactive textual

references only.

What are the Board’s recommendations?

Our Board unanimously recommends

that you vote by proxy using the WHITE proxy card with respect to the proposals as follows:

| · |

“FOR” the election of Messrs. Geygan, Foster, Crane, Bryant and McCarthy and Mses. DiBattiste and Gold to serve on the Board, each until the next annual meeting of stockholders and until his or her successor is duly elected and qualified; |

| · |

“FOR” the non-binding advisory resolution to approve the compensation of the Company’s named executive officers, as described in this proxy statement; |

| · |

“FOR” the ratification of the appointment of BDO as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2021; and |

| · |

“FOR” the approval of the Wayside Technology Group, Inc. 2021 Omnibus Incentive Plan (the “2021 Plan”). |

Who is entitled to vote at the Meeting?

The Board has set the close

of business on April 13, 2021 as the Record Date for the Meeting. You are entitled to notice and to vote if you were a stockholder of

record of Common Stock, as of the close of business on the Record Date. You are entitled to one vote on each proposal for each share of

Common Stock you held on the Record Date. Your shares may be voted at the Meeting only if you are present in person or your shares are

represented by a valid proxy. At the close of business on the Record Date, there were 4,410,035 shares of our Common Stock issued,

outstanding and entitled to vote at the Meeting.

What is the difference between a stockholder

of “record” and a “street name” holder?

If your shares are registered

directly in your name, you are considered the stockholder of record with respect to those shares. The Company sent the proxy materials

directly to you. The proxy card accompanying this proxy statement will provide information regarding internet and telephone voting for

record holders.

If your shares are held in

a stock brokerage account or by a bank, trust or other nominee, then the broker, bank, trust or other nominee is considered to be the

stockholder of record with respect to those shares. You are considered to be the beneficial owner of those shares and your shares are

said to be held in “street name,” and the proxy materials are being forwarded to you by that organization. Street name holders

generally cannot submit a proxy or vote their shares directly and must instead instruct the broker, bank, trust or other nominee how to

vote their shares. If you hold your shares in “street name,” please instruct your bank, broker, trust or other nominee how

to vote your shares using the voting instruction form provided by your bank, broker, trust or other nominee so that your vote can be counted.

The voting instruction form provided by your bank, broker or other nominee may also include information about how to submit your voting

instructions over the Internet or by telephone, if such options are available.

What constitutes a quorum?

The presence in person or

by proxy of holders of a majority of the voting power of the outstanding stock of the Company entitled to vote at the Meeting, present

in person or represented by proxy at the Meeting, constitutes a quorum, which is required to hold and conduct business at the Meeting.

Shares are counted as present at the Meeting if:

| · |

|

you are present in person at the Meeting; or |

| · |

|

your shares are represented by a properly authorized and submitted proxy (submitted over the Internet, by telephone or by mail). |

If you are a record holder

and you submit your proxy, regardless of whether you abstain from voting on one or more matters, your shares will be counted as present

at the Meeting for the purpose of determining a quorum. If your shares are held in “street name,” your shares are counted

as present for purposes of determining a quorum if you provide voting instructions to your broker, bank, trust or other nominee and such

broker, bank, trust or other nominee submits a proxy covering your shares. Broker non-votes (as described below) also count toward the

quorum requirement. In the absence of a quorum or for any other reason, the Meeting may be adjourned, from time to time, by the chairman

of the meeting or the Chair of our Board. In the absence of a quorum, the Meeting may be adjourned, from time to time, by a majority vote

of the stockholders present in person or represented by proxy and entitled to vote,.If the adjournment is not for more than thirty days,

the adjourned meeting may be held without any notice other than an announcement at the meeting.

How do I attend and vote at the Meeting?

You will be able to attend

the Meeting and vote and submit questions during the Meeting via live audio webcast by visiting www.virtualshareholdermeeting.com/WSTG2021.

You must enter the 16-digit voting control number found on your proxy card, voting instruction form or notice that you received previously.

If you do not have your control number, you may elect to participate in the Meeting as a “Guest”, but you will not have access

to vote your shares or ask questions during the virtual Meeting.

Online access to the audio

webcast will open approximately 15 minutes prior to the start of the Meeting to allow time for you to log in and test the computer audio

system. We encourage our stockholders to access the Meeting prior to the start time.

How do I vote my shares without attending

the Meeting?

The process for voting your

shares depends on how your Common Stock is held. Generally, you may hold Common Stock in your name as a “stockholder of record”

or in an account with a broker, bank, trust or other nominee (i.e., in “street name”). If your shares are registered in your

name, you may vote your shares in person at the Meeting or by proxy whether or not you attend the Meeting. You may vote using any of the

following methods:

| |

· |

By Internet — Stockholders of record may submit proxies over

the Internet at www.virtualshareholdermeeting.com/WSTG2021, as described in the Internet voting instructions on the proxy

card. Most stockholders who hold shares beneficially in street name may provide voting instructions by accessing the website specified

on the voting instruction forms provided by their brokers, banks, trusts or nominees. Please check the voting instruction form for

Internet voting availability. |

| |

· |

By Telephone — Stockholders of record may submit proxies by telephone by calling (866) 414-9273 if in the United States or Canada, as described in the telephone voting instructions on their proxy cards. Most stockholders who hold shares beneficially in street name and live in the United States or Canada may provide voting instructions by telephone by calling the number specified on the voting instruction forms provided by their brokers, banks, trusts or nominees. Please check the voting instruction form for telephone voting availability. |

| |

· |

By Mail — Stockholders of record may submit proxies by completing, signing and dating the proxy cards and mailing them in the accompanying pre-addressed envelopes. Stockholders who hold shares beneficially in street name may provide voting instructions by mail by completing, signing and dating the voting instruction forms provided by their brokers, banks, trusts or other nominees and mailing them in the accompanying pre-addressed envelopes. |

Even if you plan to attend

the Meeting, we recommend that you also submit your proxy or voting instructions by Internet, telephone or mail so that your vote will

be counted if you later decide not to attend the Meeting. The Internet and telephone voting facilities will close at 11:59 p.m. ET on

June 7, 2021. Stockholders who submit a proxy by Internet or telephone need not return a proxy card or the form forwarded by your broker,

bank, trust or other holder of record by mail.

How can I change my vote or revoke my proxy?

As a stockholder of

record, if you submit a proxy, you may revoke that proxy at any time before it is voted at the Meeting. Stockholders of record may

revoke a proxy prior to the Meeting by (i) delivering a written notice of revocation that is dated later than the date of your

proxy to the attention of the Corporate Secretary at our offices at 4 Industrial Way West, 3rd Floor, Eatontown, New Jersey 07724,

(ii) signing and delivering a later-dated proxy over the Internet, by telephone or by mail, that we receive no later than 11:59

p.m. ET on June 7, 2021 or (iii) attending and voting at the Meeting. Attendance at the Meeting will not, by itself, revoke a

proxy.

If your shares are held in

the name of a broker, bank, trust or other nominee, you may change your voting instructions by following the instructions of your broker,

bank, trust or other nominee.

How will my shares be voted?

Stockholders of record as

of the close of business on the Record Date, are entitled to one vote for each share of Common Stock held on each matter to be voted upon

at the Meeting. All shares entitled to vote and represented by properly submitted proxies received before the polls are closed at the

Meeting, and not revoked or superseded, will be voted at the Meeting in accordance with the instructions indicated on those proxies. If

you return a validly executed proxy card without indicating how your shares should be voted on a matter and you do not revoke your proxy,

your proxy will be voted: “FOR” the election of the seven Board nominees (Proposal 1); “FOR” the

non-binding, advisory resolution approving the compensation of the Company’s named executive officers (Proposal 2); “FOR”

the ratification of the appointment of BDO as our independent registered public accounting firm for the fiscal year ended December 31,

2021 (Proposal 3); and “FOR” the approval of the 2021 Plan (Proposal 4).

What is discretionary voting? What is a

broker non-vote?

A broker non-vote occurs when

the broker is unable to vote on a proposal because the proposal is not routine and the stockholder who owns the shares in “street

name” has not provided any voting instructions to the broker on that matter. The New York Stock Exchange (“NYSE”) rules

determine whether proposals are routine or not routine. If a proposal is routine, a broker holding shares for an owner in street name

may vote on the proposal without voting instructions. Proposal 1, Proposal 2 and Proposal 4 are considered non-discretionary matters,

and a broker will lack the authority to vote uninstructed shares at their discretion on such proposals. Proposal 3 is considered a discretionary

matter, and a broker will be permitted to exercise its discretion to vote uninstructed shares on the proposal. If your shares are held

in street name, please follow the voting instructions that you receive from that institution. The institution will not be able to vote

your shares on any of the proposals except the ratification of the appointment of BDO unless you have provided voting instructions. Broker

non-votes are not treated as entitled to vote for all other matters proposed for a vote at the meeting, so they will have no effect on

those matters.

What is the effect of abstentions and broker

non-votes on voting?

Abstentions and broker non-votes

will be counted as present at the Meeting for the purpose of determining a quorum. Because the election of each director nominee will

require a plurality of the shares of Common Stock present in person or represented by proxy entitled to vote at the Meeting, “withhold”

votes have no effect on the outcome of Proposal 1. Abstentions may not be specified with respect to Proposal 1. To approve the advisory

vote on the compensation of the Company’s named executive officers, to ratify the appointment of BDO as the Company’s independent

registered public accounting firm for 2021, and to approve the 2021 Plan, if a quorum is present, the affirmative vote of a majority of

the shares of Common Stock present in person or represented by proxy at the Meeting and entitled to vote is required for approval. As

a result, abstention votes will have the same effect as a vote against such matters. Broker non-votes are not treated as entitled to vote

on Proposals 1, 2 and 4, so they will have no effect on those matters. Proposal 3 is considered a discretionary matter, and there will

be no broker non-votes on this proposal.

Could other matters be decided at the Meeting?

We do not expect any other

items of business will be presented for consideration at the Meeting other than those described in this proxy statement. However, by completing,

signing, dating and returning the proxy card or submitting your proxy or voting instructions over the Internet or by telephone, you will

give to the persons named as proxies discretionary voting authority with respect to any matter that may properly come before the Meeting.

Who will count the votes?

All votes will be tabulated

as required by Delaware law, the state of our incorporation, by the inspector of election appointed for the Meeting in accordance with

the Bylaws, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

When will the voting results be announced?

The final voting results will

be reported in a Current Report on Form 8-K, which will be filed with the SEC within four business days after the Meeting. If our final

voting results are not available within four business days after the Meeting, we will file a Current Report on Form 8-K reporting the

preliminary voting results and subsequently file the final voting results in an amendment to the Current Report on Form 8-K within four

business days after the final voting results are known to us.

What vote is required

with respect to the proposals?

Election of Directors.

Pursuant to our Bylaws, the affirmative vote of a plurality of the shares of Common Stock present in person or represented by proxy entitled

to vote at the Meeting is necessary for the election of directors under Proposal 1 at the Meeting. This means that the nominees receiving

the highest number of “FOR” votes of the shares entitled to be voted in the election of directors will be elected. You may

vote “FOR” all Board nominees, “WITHHOLD” your vote as to all Board nominees, or “FOR ALL” Board nominees

except the specific nominee from whom you “WITHHOLD” your vote. There is no “against” option. Shares voting

“WITHHOLD” are counted for purposes of determining a quorum. However, if you withhold authority to vote with respect to the

election of any or all of the nominees, your shares will not be voted with respect to those nominees indicated. Therefore, “WITHHOLD”

votes will not affect the outcome of the election of directors. Brokers do not have discretionary authority to vote on the election of

directors. Broker non-votes and “WITHHOLD” votes will have no effect on the outcome of Proposal 1. Proxies may not be

voted for more than the number of director nominees listed on the submitted proxy card and stockholders may not cumulate votes.

Non-binding Resolution

to Approve Compensation for Named Executive Officers. The approval of a non-binding, advisory resolution approving the compensation

of the Company’s named executive officers requires the affirmative vote of a majority of the shares of Common Stock present in person

or represented by proxy at the Meeting and entitled to vote. You may vote “FOR,” “AGAINST” or “ABSTAIN.”

If you “ABSTAIN” from voting on Proposal 2, the abstention will have the same effect as an “AGAINST” vote. While

the vote on Proposal 2 is advisory, and will not be binding on the Company or the Board, the Board will review the results of the voting

on this proposal and take it into consideration when making future decisions regarding executive compensation as we have done in this

and previous years. Broker non-votes will have no effect on the outcome of Proposal 2.

Ratification of Auditors.

The ratification of the appointment of BDO requires the affirmative vote of a majority of the shares of Common Stock present in person

or represented by proxy at the Meeting and entitled to vote. You may vote “FOR,” “AGAINST” or “ABSTAIN.”

If you “ABSTAIN” from voting on Proposal 3, the abstention will have the same effect as an “AGAINST” vote. Proposal

3 is considered a discretionary matter, and a broker will be permitted to exercise its discretion to vote uninstructed shares on the proposal.

Approval of the 2021

Plan. The approval of the 2021 Plan requires the affirmative vote of a majority of the shares of Common Stock present in person

or represented by the proxy at the Meeting and entitled to vote. You may vote “FOR,” “AGAINST” or “ABSTAIN”.

If you “ABSTAIN” from voting on Proposal 4, the abstention will have the same effect as an “AGAINST” vote. Broker

non-votes will have no effect on the outcome of Proposal 4.

Who will pay for the solicitation of proxies?

The Company will bear the

entire cost of solicitation of proxies, including preparation, assembly and mailing of this proxy statement, the proxy card, the Notice

of Annual Meeting of Stockholders and any additional information furnished to stockholders. Copies of solicitation materials will be furnished

to banks, brokerage houses, fiduciaries and custodians holding shares of our Common Stock in their names that are beneficially owned by

others to forward to those beneficial owners. We may reimburse persons representing beneficial owners for their costs of forwarding the

solicitation materials to the beneficial owners. Proxies may be solicited by telephone, facsimile, electronic mail or personal solicitation.

Our directors, officers, and employees may also solicit proxies for no additional compensation.

Do I have appraisal or dissenters’

rights?

None of the applicable Delaware

law, our Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”), nor our Bylaws, provide for

appraisal or other similar rights for dissenting stockholders in connection with any of the proposals set forth in this proxy statement.

Accordingly, you will have no right to dissent and obtain payment for your shares in connection with such proposals.

CORPORATE GOVERNANCE

Role of the Board of Directors

In accordance with the General

Corporation Law of the State of Delaware and our Certificate of Incorporation and Bylaws, our business, property and affairs are managed

under the direction of the Board. Although our non-employee directors are not involved in our day-to-day operating details, they are kept

informed of our business through written reports and documents provided to them regularly, as well as by operating, financial and other

reports presented by our officers at meetings of the Board and committees of the Board.

Board Leadership Structure

The

Board believes it is appropriate to separate the roles of Chief Executive Officer (“CEO”) and Chair of our Board (“Board

Chair”) as a result of the demands of and differences between each role. Jeff Geygan serves as the Board Chair. Dale Foster

serves as our CEO and as a member of our Board. Our Board believes that this leadership structure provides the most efficient and effective

leadership model for our Company by enhancing the ability of the Board Chair and CEO to provide clear insight and direction of business

strategies and plans to both the Board and management. Separating the CEO and Board Chair roles

allows us to efficiently develop and implement corporate strategy that is consistent with the Board's oversight role, while facilitating

strong day-to-day executive leadership.

The duties and responsibilities

of our Board Chair include: (i) chairing Board meetings, including presiding over all executive sessions of the Board (without management

present) at every regularly scheduled Board meeting; (ii) consulting with the CEO on such other matters as are pertinent to the Board

and the Company; (iii) working with management to determine the information and materials provided to Board members; (iv) approving Board

meeting schedules, agenda and other information provided to the Board; (v) the authority to call meetings of the independent directors;

(vi) serving as principal liaison between the independent directors and the CEO and between the independent directors and senior management;

and (vii) being available for direct communication and consultation with stockholders upon request. Our

CEO is responsible for setting the strategic direction for the Company, with guidance from the Board. The CEO is also responsible for

the day-to-day leadership and performance of the Company, while the Board Chair provides guidance to the CEO, sets the agenda for

Board meetings and presides over meetings of the full Board.

Another key component of our

leadership structure is our strong governance practices designed to ensure that the Board effectively carries out its responsibility for

the oversight of management. All of our directors, except Mr. Foster, are independent, and all Board committees are comprised entirely

of independent directors. Our independent directors meet at each Board meeting in regularly scheduled executive sessions (not less than

twice per year) and may schedule additional executive sessions as appropriate. Members of management do not attend these executive sessions.

The Board has full access to the management team at all times. In addition, the Board or any committee thereof may retain, on such terms

as determined by the Board or such committee, as applicable, in its sole discretion, independent legal, financial and other consultants

and advisors to assist the Board or committee, as applicable, in discharging its oversight responsibilities.

Board Oversight of Risk Management

Our Board believes that overseeing

how management manages the various risks we face is one of its most important responsibilities to the Company’s stakeholders. The

Board believes that, in light of the interrelated nature of the Company’s risks, oversight of risk management is the responsibility

of the full Board. In carrying out this critical duty, the Board meets at least annually with key members of management holding primary

responsibility for management of risk in their respective areas. The Risk and Security Committee assists the Board in its oversight responsibilities

with regard to the Company’s risk management framework and management’s identification, assessment and management of the Company’s

key strategic, enterprise and other risks. Additionally, the Audit Committee has certain oversight functions, including discussing with

management the Company’s major financial risk exposures and steps that management has taken to monitor and control such exposures,

including the Company’s risk assessment and risk management policies.

Meetings of the Board of Directors

The Board met twelve times

in 2020. Each of the directors attended at least 75% of all meetings held by the Board and meetings of each committee of the Board on

which such director served during 2020.

Communication with the Board of Directors;

Director Attendance at Annual Meetings

Stockholders may communicate

with a member or members of the Board by addressing their correspondence to the Board member or members c/o the Corporate Secretary, Wayside

Technology Group, Inc., 4 Industrial Way West, 3rd Floor, Eatontown, New Jersey 07724. Our Corporate Secretary will review the correspondence

and forward it to the chair of the appropriate committee or to any individual director or directors to whom the communication is directed,

unless the communication is unduly hostile, threatening and illegal, does not reasonably relate to the Company or our business, or is

similarly inappropriate. Our Corporate Secretary has the authority to discard or disregard any inappropriate communications or to take

other appropriate actions with respect to any such inappropriate communications.

Recognizing that director

attendance at our annual meetings can provide our stockholders with a valuable opportunity to communicate with Board members about issues

affecting our Company, we encourage our directors to attend each annual meeting of stockholders. Ms. DiBattiste was nominated to the Board

at last year’s annual meeting. All of the directors then serving on the Board attended last year’s annual meeting of stockholders.

Director Independence

The Board has determined that

the following directors are independent under the NASDAQ listing standards: Messrs. Geygan, McCarthy, Bryant and Crane and Mses. Kurty

and DiBattiste. The Board has also determined that Ms. Gold, a director nominee not currently serving on the Board, would be considered

independent under the NASDAQ listing standards if elected. In determining Ms. Gold’s independence, the Board considered certain

non-material purchases of products from the Company by Hewlett Packard Enterprise Company, the parent company of Ms. Gold’s employer,

made in the ordinary course of business. Ms. Gold is not involved in these purchases in any way, and the Board determined that in its

opinion these transactions would in not in any way interfere with Ms. Gold’s exercise of independent judgment in carrying out her

responsibilities of a director.

Committees of the Board of Directors

The Board has four standing

committees: an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee and a Risk and Security Committee

(each, a “Committee” and collectively, the “Committees”).

Audit Committee.

The Board has an Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Audit Committee: (i) monitors

the integrity of the Company’s financial statements, financial reporting process and internal controls regarding finance, accounting

and legal compliance; monitors the independence and performance of our independent registered public accounting firm; (ii) provides an

avenue of communication among the independent registered public accounting firm, management, and our outsourced internal auditors, and

our Board; and (iii) monitors significant litigation and financial risk exposure. The current members of the Audit Committee are Ms. Kurty

(Chair) and Messrs. Geygan and Crane, each of whom is independent as defined by the NASDAQ listing standards and applicable SEC rules.

The Board has determined that Ms. Kurty meets the criteria as an “audit committee financial expert” as defined in applicable

SEC rules. The Audit Committee met seven times during 2020.

The Audit Committee operates

under a written charter adopted by the Board. A copy of the charter is available on our website at http://www.waysidetechnology.com/ in

the Committee Charters section under the Governance tab.

Compensation

Committee. The Board has a Compensation Committee which: (i) reviews and monitors matters related to management

development and succession; (ii) develops and implements executive compensation policies and pay for performance criteria for the

Company; (iii) reviews and approves the initial and annual base salaries, annual incentive bonus and all long-term incentive awards

of our Chief Executive Officer; (iv) reviews and approves such compensation arrangements for all executive officers and certain

other key employees; (v) approves stock-related incentives under our stock incentive and executive compensation plans, and exercises

all powers of the Board under those plans other than the power to amend or terminate those plans and other than those with respect

to non-employee directors, which determinations are subject to approval by the full Board; (vi) reviews and approves material

matters concerning our employee compensation and benefit plans; and (vii) carries out such responsibilities as have been delegated

to it under various compensation and benefit plans and such other responsibilities with respect to our compensation matters as may

be referred to it by our Board or management. Under its charter, the Compensation Committee may form and delegate authority to

subcommittees or, to the extent permitted under applicable laws, regulations and NASDAQ rules, to any other independent director, in

each case to the extent the Compensation Committee deems necessary or appropriate. The Compensation Committee has the right to

consult with or obtain input from management but, except as expressly provided in its charter, may not delegate any of its

responsibilities to management. The current members of the Compensation Committee are Messrs. McCarthy (Chair) and Bryant and Ms.

DiBattiste, each of whom is independent as defined by the NASDAQ listing standards. The Compensation Committee met twice during

2020.

The Compensation Committee

operates under a written charter adopted by the Board, a copy of which is available on our website at http://www.waysidetechnology.com/ in

the Committee Charters section under the Governance tab.

Nominating and Corporate

Governance Committee. The Board has a Nominating and Corporate Governance Committee which identifies individuals qualified

to become Board members and recommends to the Board director nominees for election at the next Annual Meeting of Stockholders. Currently,

the members of the Nominating and Corporate Governance Committee are Messrs. Bryant (Chair), Geygan and McCarthy, each of whom is independent

as defined by the NASDAQ listing standards. The Nominating and Corporate Governance Committee met three times during 2020.

The Nominating and Corporate

Governance Committee operates under a written charter adopted by the Board. The Nominating and Corporate Governance Committee charter

is available in the Committee Charters section under the Governance tab of our website at http://www.waysidetechnology.com/.

Risk and Security Committee.

The Board has a Risk and Security Committee which assists the Board in its oversight responsibilities with regard to the Company's

risk management framework and management’s identification, assessment and management of the Company’s key strategic, enterprise

and other risks, including overseeing (i) the Company’s key strategic, enterprise and security risks, including, but not limited

to, workplace and cybersecurity safety, (ii) privacy risk, including potential impact to the Company’s employees, customers

and stakeholders, (iii) management’s implementation of risk policies and procedures, and (iv) the Company’s risk culture,

i.e., the tone and culture within the Company regarding risk and the integration of risk management into the Company’s behaviors,

decision making and processes. Currently, the members of the Risk and Security Committee are Mr. Crane (Chair) and Mses. Kurty and DiBattiste,

each of whom is independent as defined by the NASDAQ listing standards. Mr. Crane has served as the Chair of the Risk and Security Committee

since February 2020. The Risk and Security Committee met two times during 2020.

The Risk and Security Committee

operates under a written charter adopted by the Board. The Risk and Security Committee charter is available in the Committee Charters

section under the Governance tab of our website at http://www.waysidetechnology.com/.

Director Nominations

Nominees may be recommended

by directors, members of management, or, in some cases, by a third-party firm. In identifying and considering candidates for nomination

to the Board, the Nominating and Corporate Governance Committee considers, in addition to the requirements described below and set out

in its charter, quality of experience, our needs and the range of knowledge, experience and diversity represented on the Board. Each director

candidate will be evaluated by the Nominating and Corporate Governance Committee based on the same criteria and in the same manner, regardless

of whether the candidate was recommended by a Company stockholder or by others. The Nominating and Corporate Governance Committee will

conduct the appropriate and necessary inquiries with respect to the backgrounds and qualifications of all director nominees. The Nominating

and Corporate Governance Committee will also review the independence of each candidate and other qualifications of all director candidates,

as well as consider questions of possible conflicts of interest between director nominees and our Company.

After the Nominating and Corporate

Governance Committee has completed its review of a nominee’s qualifications and conducted the appropriate inquiries, the Nominating

and Corporate Governance Committee will make a determination whether to recommend the nominee for approval by the Board. If the Nominating

and Corporate Governance Committee decides to recommend the director nominee for approval by the Board and such recommendation is accepted

by the Board, the form of our proxy solicitation will include the name of the director nominee.

In addition to the candidates

nominated by the Board pursuant to the recommendations of the Nominating and Corporate Governance Committee in the manner set forth above,

the Nominating and Corporate Governance Committee will consider recommendations for directorships submitted by our stockholders. Stockholders

who wish the Nominating and Corporate Governance Committee to consider their recommendations for nominees for the position of director

should submit their recommendations in writing to: Corporate Secretary, Wayside Technology Group, Inc., 4 Industrial Way West, 3rd Floor,

Eatontown, New Jersey 07724.

In its assessment of

each potential candidate, the Nominating and Corporate Governance Committee will review the nominee’s professional ethics,

integrity and values, skills, judgment, experience, independence, commitment to representing the long-term interests of the

stockholders, understanding of our Company’s or other related industries and such other factors as the Nominating and

Corporate Governance Committee determines are pertinent in light of the current needs of the Board. The Nominating and Corporate

Governance Committee seeks to identify candidates representing diverse thought and experience at policy-making levels in business,

management, marketing, finance, human resources, communications, risk and compliance and in other areas that are relevant to our

activities. The Nominating and Corporate Governance Committee will also take into account the ability of a director to devote the

time and effort necessary to fulfill his or her responsibilities to our Company. After full consideration, the stockholder proponent

will be notified of the decision of the Nominating and Corporate Governance Committee.

Director Compensation and Arrangements

The following table sets forth

information regarding the compensation earned by or awarded to each director, who is not a named executive officer who served on the Board,

for the fiscal year ended December 31, 2020.

| |

|

Fees

Earned or

Paid In |

|

|

Stock |

|

|

|

|

| Name |

|

Cash ($) |

|

|

Awards ($) (2) |

|

|

Total ($) |

|

| Mike Faith (1) |

|

|

30,000 |

|

|

|

- |

|

|

|

30,000 |

|

| Diana Kurty |

|

|

85,000 |

|

|

|

60,280 |

|

|

|

145,280 |

|

| Jeff Geygan |

|

|

100,000 |

|

|

|

60,280 |

|

|

|

160,280 |

|

| John McCarthy |

|

|

75,000 |

|

|

|

60,280 |

|

|

|

135,280 |

|

| Andy Bryant |

|

|

75,000 |

|

|

|

60,280 |

|

|

|

135,280 |

|

| Ross Crane (3) |

|

|

80,000 |

|

|

|

99,271 |

|

|

|

179,271 |

|

| Carol DiBattiste (1) (3) |

|

|

30,000 |

|

|

|

66,990 |

|

|

|

96,990 |

|

|

(1)

|

Mr. Faith did not stand for re-election as

a director at the Company’s 2020 annual meeting of stockholders, and Ms. DiBattiste was elected as a director at the Company’s

2020 annual meeting of stockholders.

|

| |

|

| (2) |

The amount included in “Stock Awards”

is the aggregate grant date fair value associated with restricted stock awards granted to our outside directors in 2020, computed in accordance

with FASB ASC Topic 718. The restricted stock awards vested in full on the date of grant. See Note 10, “Stockholder’s Equity

and Stock Based Compensation” to the Company’s consolidated financial statements set forth in its Annual Report on Form 10-K

for the assumptions made in determining stock award values. |

| |

|

| (3) |

On August 7, 2020, Mr. Crane received a grant

of 1,685 shares of restricted stock and Ms. DiBattiste received a grant of 290 shares of restricted stock, all of which vested in full

on the date of grant, for their service on the Board since the date of their respective appointments. |

During 2020, each outside

director (i.e., non-employee) received $15,000 per quarter for serving on the Board, as well as reimbursement for reasonable expenses

incurred in connection with services as a director. Effective February 2020, Board compensation was adjusted such that the Chair of the

Audit Committee receives an annual fee of $25,000, the Chair of the Nominating and Corporate Governance Committee receives an annual fee

of $15,000 and the Chair of the newly established Risk and Security Committee receives an annual fee of $20,000. The Chair of the Compensation

Committee continued to receive an annual fee of $15,000. There was no change to the amount the Board Chair receives, which remained at

an annual fee of $40,000. In addition, on August 7, 2020 each outside director received a grant of 2,605 shares of restricted stock, which

vested in full on the date of grant. Additionally, on August 7, 2020, Mr. Crane received a grant of 1,685 shares of restricted stock and

Ms. DiBattiste received a grant of 290 shares of restricted stock, all of which vested in full on the date of grant.

Short-Selling, Hedging and Pledging Prohibitions

We do not permit our directors,

executive officers or employees, or any of their designees, to speculate in the Common Stock of Wayside Technology Group, Inc., which

includes, without limitation, “short-selling” and/or buying publicly traded options. We also do not permit our directors,

executives or employees, or any of their designees, to purchase financial instruments (including prepaid variable forward contracts, equity

swaps, collars, and exchange funds), or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any

decrease in the market value of the Company’s equity securities (i) granted to the employee or director by the Company as part of

his or her compensation or (ii) held, directly or indirectly, by the employee or director.

Code of Business Conduct and Ethics

The full text of the Code

of Ethical Conduct, as revised, which applies to all employees, officers and directors of the Company, including our Chief Executive Officer,

Principal Financial Officer and Principal Accounting Officer is available at our website, http://www.waysidetechnology.com/site/content/code-of-ethics.

The Company will disclose any amendment to, or waiver from, a provision of the Code of Ethical Conduct that applies to our Chief Executive

Officer, Chief Financial Officer, Chief Accounting Officer or Controller on our investor relations website.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth

certain information regarding the beneficial ownership of Common Stock as of April 13, 2021 by (i) each person who, to the knowledge

of the Company, beneficially owns more than 5% of the outstanding Common Stock, (ii) each of the directors (including the nominees for

director), (iii) the Company’s named executive officers listed in the Summary Compensation Table, and (iv) all directors and

executive officers of the Company as a group. Except as indicated, each person listed below has sole voting and investment power with

respect to the shares set forth opposite such person’s name.

| Name | |

Number of Shares

Beneficially Owned | | |

Percent | |

| Directors (including all nominees) and Named Executive Officers | |

| | | |

| | |

| Jeff Geygan (1) | |

| 145,945 | | |

| 3.3 | % |

| Dale Foster (2) | |

| 65,139 | | |

| 1.5 | % |

| Vito Legrottaglie (3) | |

| 56,786 | | |

| 1.3 | % |

| Michael Vesey (4) | |

| 45,435 | | |

| 1.0 | % |

| Charles Bass (5) | |

| 30,631 | | |

| * | |

| Diana Kurty (6) | |

| 11,609 | | |

| * | |

| John McCarthy (7) | |

| 7,505 | | |

| * | |

| Andy Bryant (8) | |

| 7,105 | | |

| * | |

| Carol DiBattiste (9) | |

| 5,000 | | |

| * | |

| Ross Crane (10) | |

| 4,290 | | |

| * | |

| Gerri Gold (11) | |

| - | | |

| * | |

| All Directors (including all nominees) and executive officers as a group (11 persons) (12) | |

| 379,445 | | |

| 8.6 | % |

| Beneficial owners of more than 5% of Common Stock | |

| | | |

| | |

| FMR, LLC (13) | |

| 528,989 | | |

| 12.0 | % |

| Survivor’s Trust u/a Eighth - E&M Shea Revocable Trust and Descendant’s Trust u/a Tenth - E&M Shea Revocable Trust (14) | |

| 292,191 | | |

| 6.6 | % |

| Renaissance Technologies LLC (15) | |

| 291,796 | | |

| 6.6 | % |

To the Company’s knowledge,

except as set forth in the footnotes to this table and subject to applicable community property laws, each person named in the table has

sole voting and investment power with respect to the shares beneficially owned, which are set forth opposite such person’s name.

Unless otherwise noted below, the information as to beneficial ownership is based upon statements furnished to the Company by the beneficial

owners. For purposes of computing the percentage of outstanding shares held by each person named above, pursuant to the rules of the SEC,

any security that such person has the right to acquire within 60 days of the date of calculation is deemed to be outstanding, but such

security is not deemed to be outstanding for purposes of computing the percentage ownership of any other person.

The address for each director

and executive officer of the Company is c/o Wayside Technology Group, Inc., 4 Industrial Way West, 3rd Floor, Eatontown, New Jersey 07724.

| (1) |

Mr. Geygan is a member of our Board and our Board Chair. Mr. Geygan owns a total of 15,530 shares of Common Stock, individually. The remaining 130,415 shares are held by Global Value Investment Corp. (“GVIC”). Mr. Geygan is the Chief Executive Officer and President of GVIC and may exercise voting and dispositive power over all such shares held by GVIC. As a result, Mr. Geygan may be deemed to have a beneficial interest in such 130,415 shares held by GVIC. |

| (2) |

Includes 40,556 shares of unvested Restricted Stock. Mr. Foster is a member of our Board and our Chief Executive Officer. |

| (3) |

Includes 19,627 shares of unvested Restricted Stock. Mr. Legrottaglie is our Vice President and Chief Information Officer. |

| (4) |

Includes 29,736 shares of unvested Restricted Stock. Mr. Vesey is our Vice President and Chief Financial Officer. |

| (5) |

Includes 21,196 shares of unvested Restricted Stock. Mr. Bass is our Chief Marketing Officer. |

| (6) |

Ms. Kurty is a member of our Board. |

| (7) |

Mr. McCarthy is a member of our Board. |

| (8) |

Mr. Bryant is a member of our Board. |

| (9) |

Ms. DiBattiste is a member of our Board. |

| (10) |

Mr. Crane is a member of our Board. |

| (11) |

Ms. Gold is a director nominee to our Board. |

| (12) |

Includes 111,115 shares of unvested Restricted Stock. |

| (13) |

Based solely on information provided by FMR LLC in a Schedule 13G/A filed with the SEC on February 8, 2021. The address for FMR LLC is 245 Summer Street, Boston, Massachusetts 02210. |

| (14) |

Based on information provided in the most recent proxy questionnaire completed by John C. Morrissey, the trustee for E&M Shea Revocable Trusts. The Survivors u/a Eighth - E&M Shea Revocable Trust holds 146,096 shares with the balance of the shares held in the Descendant’s Trust u/a Tenth - E&M Shea Revocable Trust. The address for the E&M Revocable Trusts is 655 Brea Canyon Road, Walnut, California 91789. |

| (15) |

Based solely on information provided by Renaissance Technologies LLC in a Schedule 13G/A filed with the SEC on February 11, 2021. . The address for Renaissance Technologies LLC is 800 Third Avenue New York, New York 10022. |

Delinquent Section 16(a) Reports

Section 16(a) under the Exchange

Act requires the Company’s officers and directors and holders of more than ten percent of the outstanding shares of Common Stock

to file reports of ownership and changes in ownership with the SEC and to furnish the Company with copies of these reports. Based solely

upon a review of such reports, or on written representations from certain reporting persons that no reports were required for such persons,

the Company believes that during 2020 all required events of its officers, directors and 10% stockholders required to be so reported,

were timely filed except for (i) the inadvertent late filing of two transactions on a Form 4 for Dale Foster, (ii) the inadvertent late

filing of one transaction on a Form 4 for Charles Bass, and (iii) the inadvertent late filing of a Form 5 for Michael Vesey, which included

an aggregate of three small acquisitions eligible for deferred reporting pursuant to Exchange Act Rule 16a-6 that should have been filed

on a Form 5 for 2020.

PROPOSAL 1

ELECTION OF DIRECTORS

At the Meeting, seven directors

will be elected by the stockholders to serve until the next annual meeting or until their successors are elected and qualified. The accompanying

proxy will be voted for the election as directors of the nominees listed below, unless the proxy contains contrary instructions. There

are no arrangements or understandings pursuant to which a Company nominee for election as director is proposed to be elected, other than

with a director or officer acting solely in that capacity. Each of the Company’s nominees has consented to serve as a nominee, be

named in this proxy statement and to serve as a director if elected, and management has no reason to believe that any of the Company’s

nominees will not be a candidate or will be unable to serve as a director. However, in the event that any of the Company’s nominees

should become unable or, for good cause, unwilling to serve as a director, the proxy will be voted for the election of such person or

persons as shall be designated by the directors.

Set forth below is certain

information, as of April 13, 2021, with respect to each nominee:

| Name |

Age |

Principal Occupation and Experience, Qualifications, Attributes or Skills |

Director

Since |

| |

|

|

|

| Jeff Geygan |

59 |

Mr. Geygan has served as a director of the Company since February 2018, and as Board Chair since May 2018. Mr. Geygan has served as the Chief Executive Officer and President of GVIC, an investment research and advisory services firm, since he founded it in 2007. Prior to founding GVIC, Mr. Geygan served as a Senior Portfolio Manager at UBS Financial Services. Mr. Geygan has taught undergraduate and graduate-level courses at IE University in Madrid, Spain, the University of Wisconsin – Milwaukee Lubar School of Business, and the College of Charleston. He serves on the Advisory Board of the University of Wisconsin – Madison Department of Economics. Mr. Geygan received a Bachelor of Arts degree in Economics from the University of Wisconsin. The Board believes that his qualifications to serve on the Board and as Board Chair include his years of experience in the finance industry.

|

February 2018 |

| John McCarthy |

57 |

Mr. McCarthy has served as a director of the Company since June 2019. Mr. McCarthy is President and Chief Executive Officer of Mainline Information Systems, a nationally recognized technology solution provider he joined in April 2009. Mr. McCarthy previously held executive management positions with EMC, StorageApps, CNT, MCData and Virtual Iron. Mr. McCarthy served as a member of the board of directors of Nasuni Corporation until November 2019, and currently serves as a member of the Operating Board for Stripes Group, and a member of the Board of Trustees for Providence College. Mr. McCarthy received a Bachelor of Science degree in Marketing from Providence College. The Board believes that Mr. McCarthy’s qualifications to serve on the Board include his substantial industry and executive leadership experience. |

June 2019 |

| Andy Bryant |

65 |

Mr. Bryant has served as a director of the Company since July 2019. Mr. Bryant spent most of his career at Arrow Electronics, Inc. and Avnet, Inc., both Fortune 500 companies focused on supply chain services for electronic components and enterprise computing solutions globally. From April 2008 until his retirement in May 2016, Mr. Bryant held executive management positions with Arrow Electronics, Inc. Mr. Bryant was named President of the company’s Enterprise Computing Solutions business in 2008 and specified as an executive officer of the corporation. He served as the Chief Operating Officer of the company from May 2014 to May 2016. Prior to his tenure at Arrow, he served as President of Avnet’s global operating groups and as a Senior Vice President of Avnet, Inc. He was specified as a corporate officer of Avnet in 1996 and became an executive officer in 1999. Mr. Bryant received a Bachelor of Arts degree in History from the University of Maryland. The Board believes that his qualifications to serve on the Board include his years of experience in the technology distribution industry.

|

July 2019 |

| Ross Crane |

58 |

Mr. Crane has served as a director of the Company since

December 2019. Mr. Crane served as Executive Vice President and Chief Financial Officer for Nexeo Solutions, the third

largest chemical and plastics distributor in the world with $4 billion in annual revenue from 2011 to 2019. Mr. Crane

served as Chief Financial Officer for Belkin International, a large manufacturer of consumer electronic products and accessories

from 2008 to 2011. He also served in a variety of senior finance and operational roles with Ingram Micro Inc. from 2005 to 2008 and

Avnet Inc. from 1994 to 2005. Mr. Crane received a Bachelor of Science degree in Finance and Economics and a Masters of Business

Administration degree in Finance from Arizona State University. The Board believes that his qualifications to serve on the Board

include his years of extensive senior executive finance experience, as well as his public company and industry-specific

experience.

|

December 2019 |

| Dale Foster |

57 |

Mr. Foster was appointed our Chief Executive Officer and elected to our Board in January 2020. Mr. Foster previously held the positions of President of Lifeboat Distribution, Inc., a subsidiary of the Company, from July 2019 to January 2020 and Executive Vice President of the Company from January 2018 to July 2019. Mr. Foster served as Executive Vice President and General Manager of Promark Technology Inc. (“Promark”), which operated as a subsidiary of Ingram Micro Inc. From November 2012 until January 2018. From 1997 until Promark was acquired by Ingram Micro Inc. in 2012, Mr. Foster served as President and Chief Executive Officer of Promark, a value-added distributor with the core focus of distributing emerging data storage and virtualization solutions. Mr. Foster is a graduate of the Rochester Institute of Technology, where he earned a Bachelor’s of Technology in Electrical Engineering. Mr. Foster also holds an Associate’s degree in Electrical Engineering from Alfred State College. The Board believes that his qualifications to serve on the Board include his years of experience in the technology distribution industry, as well as his executive leadership experience. |

January 2020 |

| Carol DiBattiste |

69 |

Ms. DiBattiste was elected to our Board in June 2020. She

was recommended to the Nominating and Corporate Governance Committee by an advisor to the Company. Ms. DiBattiste currently serves

on the advisory board of AEye, a high performance active LiDAR technology company, serves on the board of Giant Oak, a private

artificial intelligence provider, and serves as an operating advisor of Liberty Hall Capital Partners, a private equity leader in

aerospace and defense. Ms. DiBattiste most recently served as the Chief Legal and Compliance Officer and Corporate Secretary at

comScore, Inc. (NASDAQ:SCOR) (“comScore”), a media measurement company providing marketing data and analytics to

enterprises from January 2017 to June 2020. Ms. DiBattiste served as Senior Advisor for Appeals Modernization, Office of

the Secretary from May 2016 to August 2016 and from August 2016 to January 2017 she served as Executive in Charge and Vice Chairman,

Board of Veterans’ Appeals, both with the U.S. Department of Veterans Affairs. Ms. DiBattiste served as Executive Vice

President, Chief Legal, Privacy, Security, and Administrative Officer with Education Management Corporation (OTC:EDMCQ) from March

2013 to March 2016. Prior to that, she held senior executive roles at multiple other public companies, including Geeknet, which was

acquired by GameStop (NYSE:GME) and Reed Elsevier/Lexis Nexis and ChoicePoint, both owned by RELX PLC (OTC:RLXXF). Ms. DiBattiste

also held several senior leadership positions in the U.S. Government Departments of Defense, Justice, Homeland Security, and

Veterans Affairs, including the Under Secretary of the U.S. Air Force, a Senate confirmed position. Ms. DiBattiste holds an L.L.M.,

Law from the Columbia University School of Law, a J.D. from Temple University School of Law, and a B.A., Sociology-Criminal Justice

from LaSalle University. The Board believes that her qualifications to serve on the Board include her business strategy, corporate

governance and cyber security expertise, as well as her public company and senior leadership experience in both the public and

private sectors.

|

June 2020 |

| Gerri Gold |

62 |

On April 7, 2021, the Board nominated Ms. Gold for election to the Board based on the recommendation of the Nominating and Corporate Governance Committee. Ms. Gold has served as Senior Vice President and Chief Operating Officer for HPE Financial Services, a subsidiary of Hewlett Packard Enterprise Company (NYSE:HPE) since May of 2018. Prior to that Ms. Gold was Vice President of Global Accounts, Sales, Marketing and Managing Director of Asset Management for HPE Financial Services since 2015. Ms. Gold previously held senior management positions with HPE Financial Services, Compaq and AT&T. Ms. Gold received a Bachelor of Business Administration degree from the University of Michigan and a Masters of Business Administration from New York University. The Board believes that her qualifications to serve on the Board include her business strategy experience, her years of experience in the technology industry, and senior leadership experience. |

N/A |

All directors hold office

until the next annual meeting of stockholders and until their successors are duly elected and qualified. Officers serve at the discretion

of the Board.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE COMPANY’S NOMINATED DIRECTORS.

EQUITY COMPENSATION PLAN INFORMATION

Stock Plans

2012 Plan. The

Company’s 2012 Stock-Based Compensation Plan (the “2012 Plan”) has been established by the Company to: (i) attract and

retain skilled employees and directors; (ii) motivate participants, by means of appropriate incentives, to achieve long-range goals; and

(iii) link participants’ interests with those of the Company’s stockholders through compensation that is based on the Common

Stock, and thereby promote the continued growth and financial success of the Company. At the annual stockholder’s meeting held on

June 6, 2012, the Company’s stockholders approved the 2012 Plan. The 2012 Plan was amended on June 5, 2018 to increase the number

of shares available for grant under the 2012 Plan from 600,000 to 1,000,000. The 2012 Plan authorizes the grant of Stock Options, Stock

Units, Stock Appreciation Rights, Restricted Stock, Deferred Stock, Stock Bonuses, and other equity-based awards. As of December 31, 2020,

the number of shares of Common Stock available for future award grants to employees, officers and directors under the 2012 Plan is 384,164.

In February 2021, an additional 47,190 shares of Common Stock were issued to officers for performance under the 2020 incentive compensation

plan.

Securities Authorized For Issuance Under Equity

Compensation Plans

The following table sets forth